With March already on our doorsteps, is the property market moving as quickly as the year seems to be? Let’s dive in and have a look.

Fast-paced markets often derive from an imbalance of supply and demand. With the number of available properties up by 48% on last year’s lowest records, it is clear this imbalance has evened out substantially. In turn, enabling buyers, many of whom are themselves sellers, to take their time viewing a wider range of properties and deciding what their best next move is.

As for property value, the average UK house price is currently at £362,452, whilst the average price within NR18 is £390,514. Quite a difference! However, the change of value from January to February is on average a positive percentage. At only around £14 higher per house, last month’s increase is the lowest since records began.

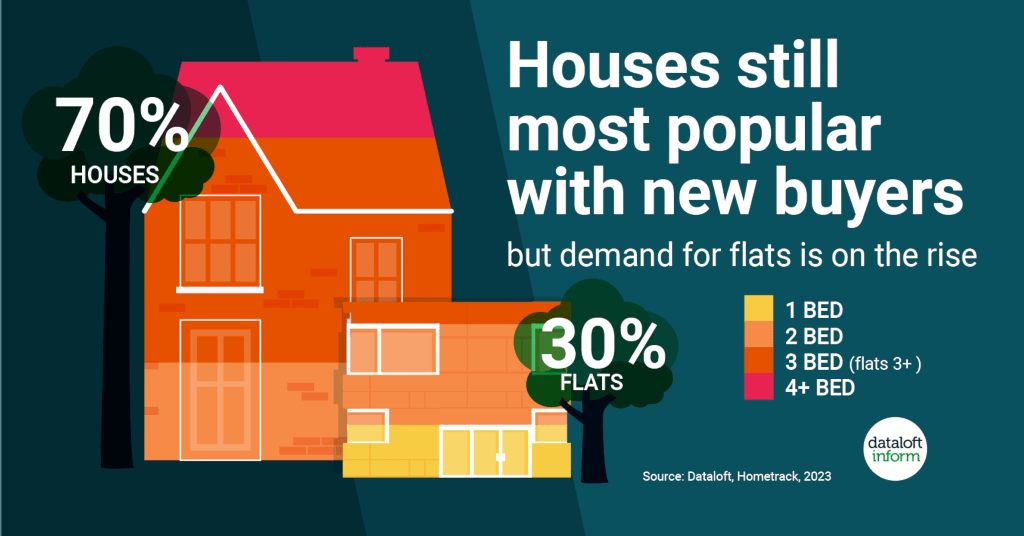

Enquiry rates have increased by 11% over the past two weeks, a figure which is likely to continue increasing the closer we get to spring. With mortgage rates gradually adjusting and rental values increasing, first time buyers are returning to market too – a fundamental cog in the workings of a healthy market.

To conclude, the property market has yet again shown resilience. Enticed by increased opportunity, buyers and sellers alike are responding well to this adjusted market. If you have thoughts on moving, there is no time like the present to start your journey.

For friendly guidance, online valuations and property appraisals, contact me via the details provided.